non filing of income tax return penalty

A There shall be imposed in addition to the tax required to be paid a penalty equivalent to twenty-five percent 25 of the amount due in the following cases. The penalty wont exceed 25 of your unpaid taxes.

The Consequences Of Not Filing Taxes

Search is initiated onafter 01072012 but before 15122016.

. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was under an. Youll have to pay more if its later or if you pay your tax bill late. Assist or advise others to under declare their income.

69 rows 270A 1 Under-reporting and misreporting of income. Taxpayers who dont meet their tax obligations may owe a penalty. If you fail to file your tax returns for 2 years or more you may be issued with a summons to attend Court.

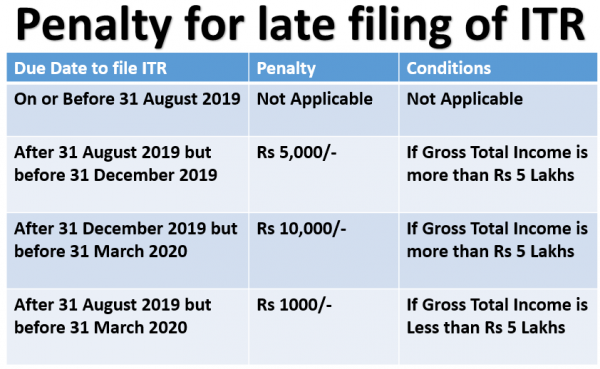

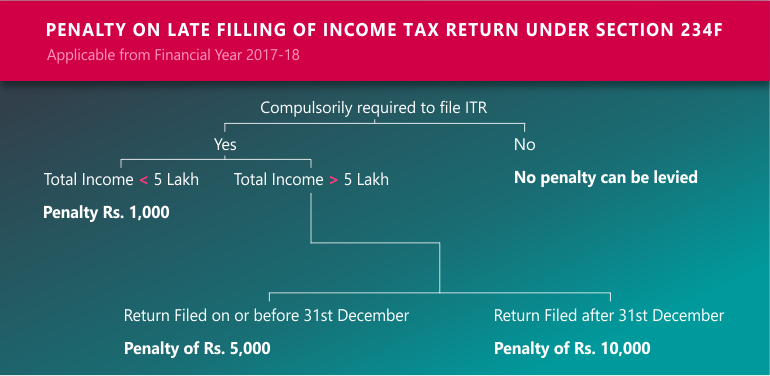

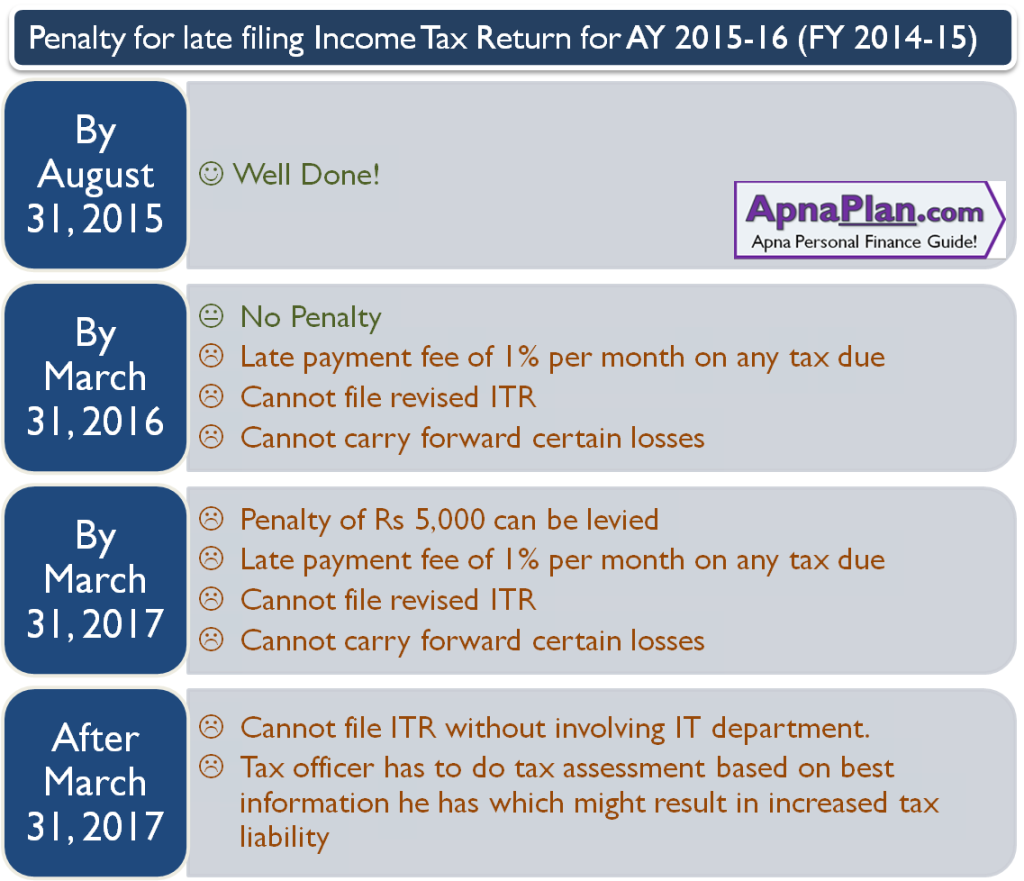

On conviction in Court you may be. As per the changed rules notified under section 234F of the Income Tax Act filing your ITR post the deadline can make you liable to pay a maximum. The Assessing Officer AO imposed penalty of Rs5000- us271F of the Act on the ground that the assessee failed to file his return of income within the time prescribed.

B If a person has a total income more. So considering the above consequences penalties you. A If a person has a total income less than or equal to Rs.

However the minimum penalty. In most cases the taxpayer is asked to pay interest 1 for late payment of income tax furnishing of return of income. Failure to file the return of income in response to a notice issued under section 142 1 i or section 148 or section 153A.

A person who fails to file return within due date will have to pay a penalty of higher of Rs1000 or 01 per cent of tax payable for each day of default. File your tax return on time. 1 Failure to file any.

Rigorous imprisonment which shall not be less than 6. Penalty-for-non-filing-of-service-tax-return-2011pdf with Size pdf 2 megabytes. However if under-reported income is in.

5 rows Here is a list of the categories of taxpayers and their penalties for not filing income tax. 5 Lakh and return is file after the due date then applicable penalty is Rs. If you wait until 60 or more days.

On average you will face a 5 penalty when you do not file a return and owe taxes. A sum equal to 50 of the amount of tax payable on under-reported income. Youll pay a late filing penalty of 100 if your tax return is up to 3 months late.

Failure to file your tax returns for 2 or more years. This will accrue each month that it is late up to five months. A person who fails to file return within due date will have to pay a penalty of higher of Rs1000- or 01 of tax payable for each day of default.

The IRS charges a penalty for various reasons including if you dont. If you have taxable income and do not file the return of Income you may end up paying. 114 1A 2000 to 20000 or imprisonment or both.

1000 to 20000 or imprisonment or both and 300 of tax undercharged. The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late. Penalty for Late Filing us 234F.

Such person shall pay a penalty of Rs5000 if the person had already paid the tax collected or withheld by him within the due date for payment and the statement is filed. If undisclosed income admitted during search. Penalty For Non Filing Of Service Tax Return 2011 creator by Dona l Ferguson.

Pay any tax you. Income include in the ITR and tax is paid before filing of return.

Filing Your Taxes Late Turbotax Tax Tips Videos

Section 234f Fee For Delay In Filing Income Tax Return Rja

The Penalty For Filing Taxes Late Past Due Even If You Owe Nothing

Penalty Relief For Late Filed Income Tax Returns Wilke Associates Cpas

7 Things To Know While Filing Itr Yadnya Investment Academy

Tax Penalties For Us Expats Failure To Pay And Failure To File

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

What Is The Penalty For Not Filing The Income Tax Return

Penalty On Late Filing Of Income Tax Return Section 234f Taxadda

Penalty Section 234f For Late Income Tax Return Filers In Ay 2020 21

Penalty You Have To Pay For Missing Late Itr Filing For Fy 2020 21 Ay 2021 22 Hostbooks

Ali Fahad Co Income Tax Return Is Mandatory To File Individuals Firm And Companies Who Are Filing Their Income Tax Returns Are Getting Benefits From Different Sector Of The Country

Penalties Against Late Filing Of Income Tax Returns Hostbooks

Penalties For Not Filing Income Tax Return Within The Due Date

Penalty For Late Filing Of Income Tax Return

October Tax Deadline Creeps Up On Millions Who Got An Extension

)

4 Days Left For Income Tax Return Deadline Penalty And Loss Of Benefits If You Miss

Individuals Unable To Pay Balance Due On 2017 Tax Returns Should Still File